Blog.

Accounts made easy.

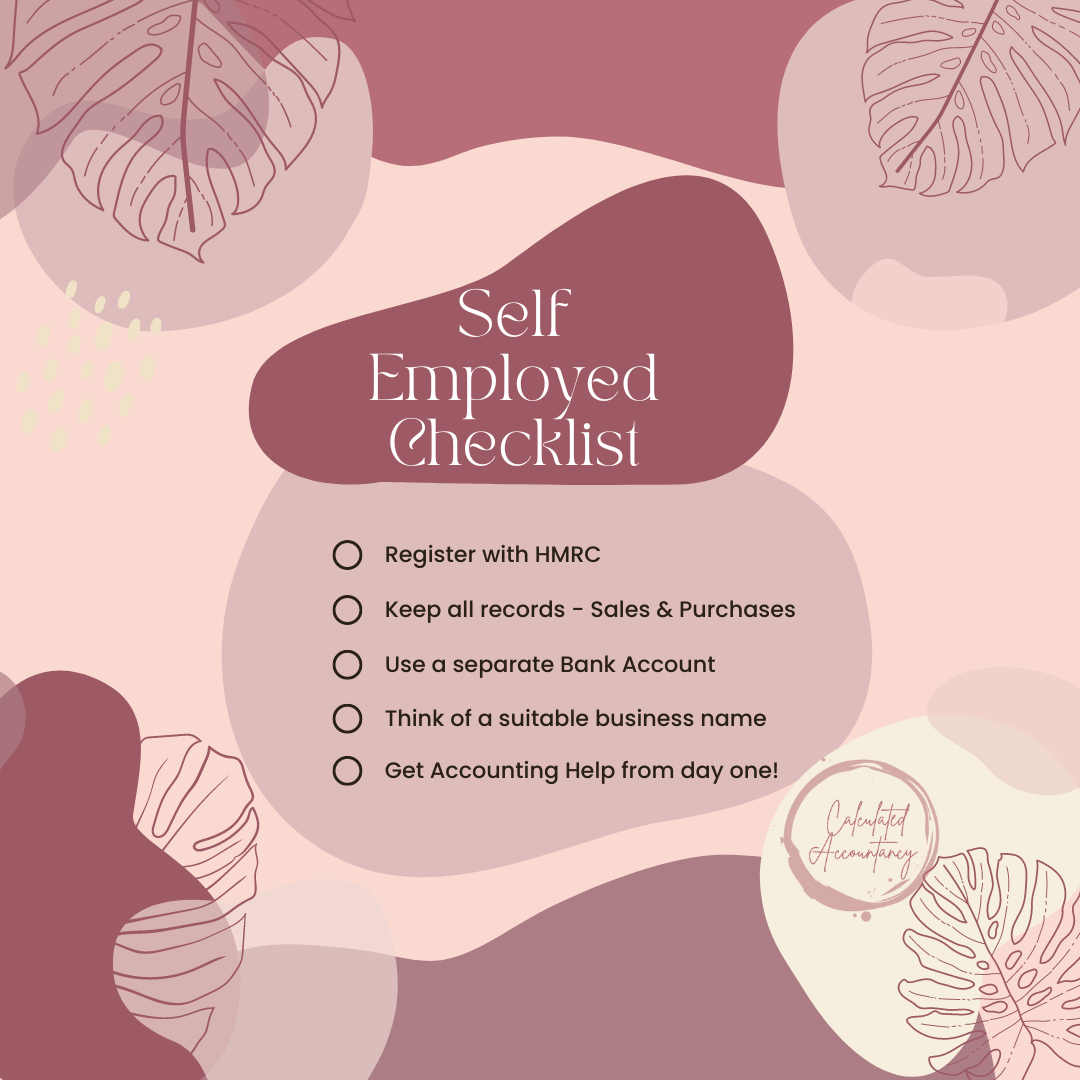

Self Employed Start-up Checklist

First things first! Congratualtions on building your dream!

Registering Self Employed with HMRC should be top of your list. You can find the details on how to register as self employed here

You need to register as self employed no later than the 5th October in your businesses second year. Earlier is best.

Keeping all records! You need to keep a record of all your sales and your business purchases. Your total sales is called your turnover. Your purchases are offset from your turnover leaving you with your profit. Profit is what you are taxed on. So keeping your receipts is VITAL these should be wholly and exclusively business related. You can find more information on self employed business expenses in a previous blog - Self Employed Expenses

Bank Accounts. There is no need to get a specific 'business bank account' however a separate bank account really does help with your business cashflow (and I don't really need to see where you get your takeaways, where buy your lingerie, or where you bet on the football). There are now free business bank accounts out there such as Starling Bank. Starling is recommended by myself purely because its free (Unless you deposit cash) It also has 'Spaces' which is a great business tool to keep your money together, however separate your Tax Bill Space. When starting up I always recommend when you are paid by your customer, you immediately move 20% of that income to a space in the bank. This is then used when its time to pay your Tax. If you were employed this is how you would be paid right? You're automatically paid your Net Income and your Employer pays your Tax on your behalf. This works exactly the same. The benefit of working like this means, you will ALWAYS have enough money to pay your tax bill!

Business Naming is a really hard decision and not one to take lightly. You can't foresee the future but you can prepare if your dream business is likely to expand. Do you want to employ staff in the future? Would you like to expand your services in the future? Your Brand is key for customers to identify you from your competitors. Make it the right one from day one....

Accounting help and Support.

There are so many questions from day one. The government website has a mountain of knowledge but its mostly hidden within vast amounts of other information, most people read and feel information overload. How to register, which software to use, how do I invoice, how to keep records, what can I claim, how do I claim... The thing with accountancy, the regulations change so often its hard to keep up. For example Making Tax Digital is coming to Self Employed soon. Have you heard of it? Do you know whats going to happen or how it will effect you... Keep posted for the next blog.

Laura